Discover the BlockFX Artificial Intelligence

BlockFX Forex AI Algorithms

Our Forex AI systems are designed to analyze vast amounts of financial data, including historical price patterns, economic indicators, market news, strategies and signals from top providers, to make informed trading decisions. These AI algorithms can identify trends, patterns, and correlations that human traders might overlook, enabling them to generate insights and predictions about future market movements.

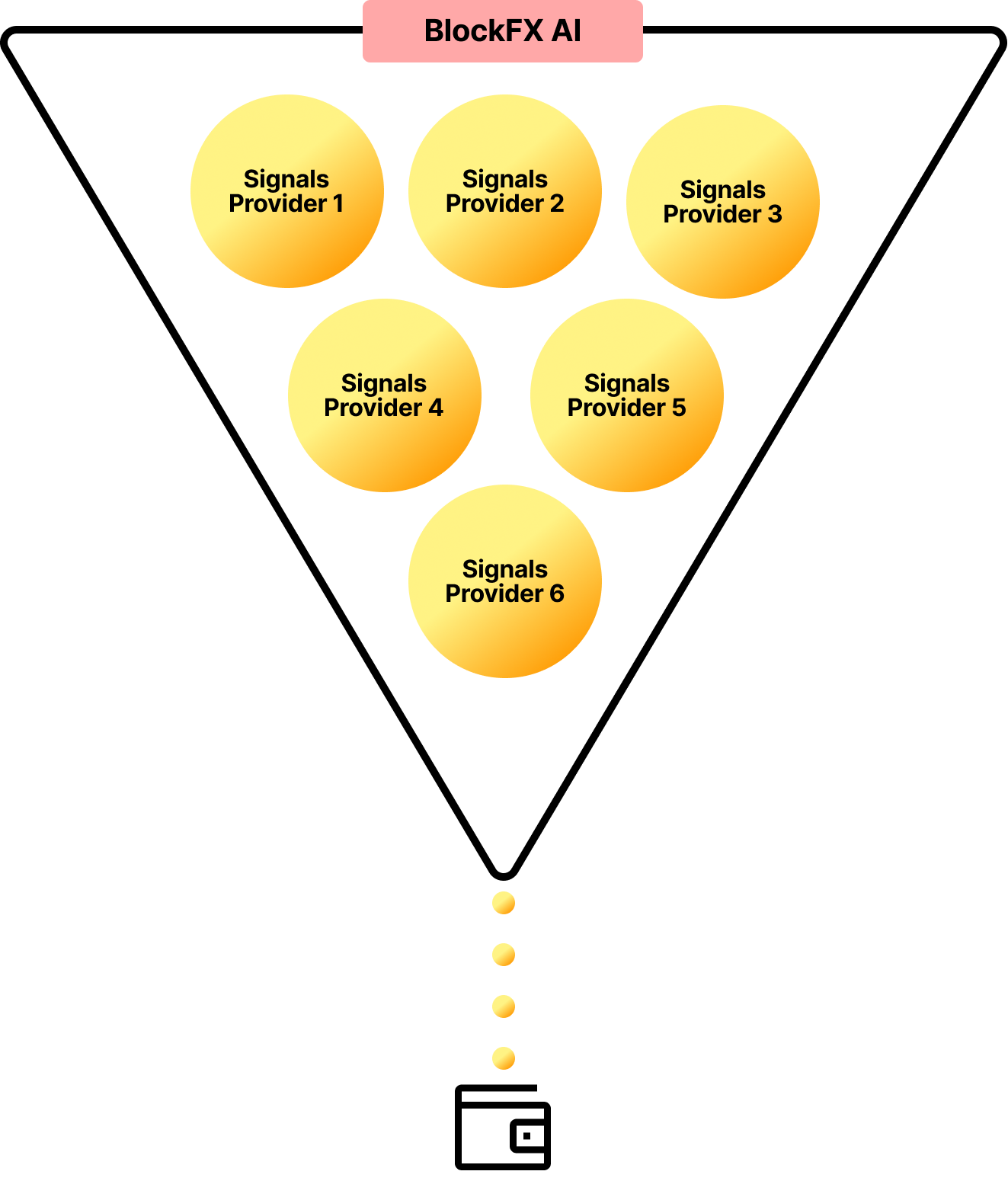

Forex Strategies and Signals

BlockFX proprietary artificial intelligence systems generates trading orders

BlockFX AI utilizes advanced machine learning algorithms to scrutinize every trade signal from leading providers and historical market data, along with economic news, in order to validate each trade. Through the analysis and learning from extensive data, these AI systems can unveil concealed correlations and offer more precise predictions regarding future price movements.

BlockFX Core 3

Our algorithmic trading and automation is widely recognized for its benefits, including accuracy, consistency, opportunity and advanced multi-asset capabilities: BlockFX Core 3

- Multi-asset analysis: Simultaneously test multiple assets, allowing optimization of strategies across an entire portfolio and producing a single equity curve.

- Multi-timeframe analysis: Analyze multiple timeframes concurrently, customizing timeframes for entry, risk management, and more.

- Full exposure control: Exercise complete control over exposure, including limiting positions by percentage and setting maximum total lot exposure.

- Custom metrics: Utilize built-in custom performance metrics like CAGR/MeanDD, Pearson’s R, and Equity Curve Straightness for accurate performance measurement.

- Session control: Determine when the system trades with up to 3 daily trading sessions and the ability to close trades at the end of sessions, days, or weeks.

- Custom news filter: Leverage one of the most advanced news filters, allowing full customization of over 820 available events such as CPI, GDP, and GDT.

- Dynamic risk oscillation: Benefit from 5 different oscillation functions, each with 3 modes of application, offering advanced risk and exposure management.

- Volatility adaptation: Adapt your algorithm based on current market volatility, with complete control over the entire system or specific parts of it.

- Advanced stop-loss control: Choose between volatility-based calculation methods or price-based modes, with full customization and anchor point control.

- Proprietary indicators: BlockFX own custom indicators with full feature and logic customization, including 9 types of moving averages and Bollinger Bands.

- Divergence, breakouts, and more: Utilize over 40 modes of indicator logic interpretation for both directional and non-directional indicators, such as two-line cross, divergence, fractal and swing breakouts, and zone crosses.

- Advanced trailing stops: Implement trailing positions using either volatility or one of nine moving averages, with full customization of start, step, and parameters.

- Built-in indicators: A wide array of built-in indicators like RSI, Stochastic, Linear Regression, MACD, Ichimoku, QQE, ADX, DPO, and more, all with full features and logic customization.

- Position scaling: Open up to 4 partial positions for scaling out, each with full take profit control. Scale in to winning positions with precise position size and stop-loss control.

- Currency strength: When trading forex, use currency strength filtering to assess performance relative to other currencies on any timeframe.

- CPU: 96 vCPU

- Memory: 255 GB RAM

- Storage: 1280 GB SSD

- Bandwith: 12 TB